Overview

- Sydney property prices have declined by 1.7% over four months, a faster pace than the 2017-2019 downturn but less severe than the sharp 12.4% drop in 2022-2023.

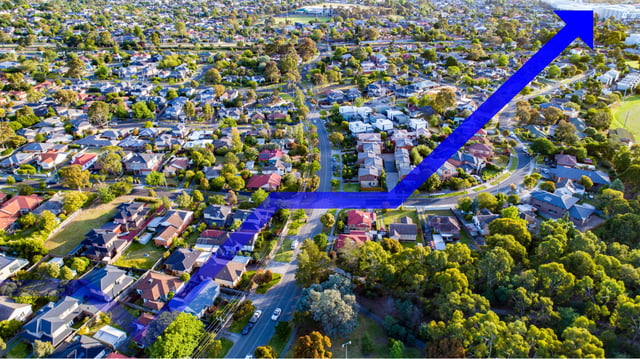

- Melbourne's property values have fallen 3.9% over 10 months, a more gradual decline compared to the 7.9% drop during the 2022-2023 downturn.

- The Reserve Bank's recent interest rate cut is expected to stabilize housing markets, with experts cautioning against expecting immediate or significant price growth.

- Economists anticipate modest improvements in buyer sentiment and borrowing capacity, though further rate cuts are not guaranteed in the near term.

- Housing affordability challenges persist, with Sydney's median house price at $1.47 million, nearly double the median unit price, while Melbourne benefits from relatively higher affordability.