Overview

- Atlas agreed to buy The ODP Corporation for $28 per share in cash, a 34% premium, valuing the deal at about $1 billion.

- The transaction has unanimous board approval and is targeted to close by late 2025 pending regulatory and shareholder approvals, after which ODP would be privately held and delisted.

- ODP shares rose roughly 33% following the announcement, trading above $33 intraday on Monday.

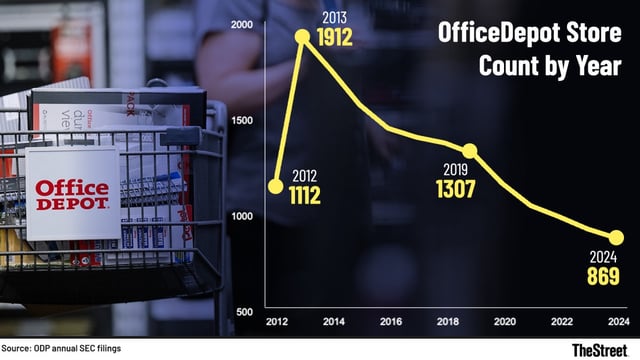

- ODP has closed more than 1,000 stores since its 2013 OfficeMax merger and reported about $7 billion in 2024 revenue as it shifts toward business-to-business services.

- Atlas, a Greenwich, Connecticut firm founded in 2002 that owns 29 manufacturing and distribution businesses, has not detailed any post-deal retail changes.