Overview

- Australia’s S&P/ASX 200 jumped about 1.25% by midday Thursday, led by gains in materials and financials, with BHP up roughly 2% as miners and banks paced the advance.

- ADP reported a 32,000 drop in U.S. private payrolls, and Fed funds futures shifted to price a near‑certain 25bp October cut, helping push gold to a record near $3,895 before easing to around $3,865.

- The U.S. shutdown halted official data releases including nonfarm payrolls, while the dollar steadied after the Supreme Court set a January hearing on President Trump’s bid to remove Fed Governor Lisa Cook, keeping her in place for now.

- The RBA kept rates on hold with a hawkish tone that lowered near‑term cut expectations, and its Financial Stability Review flagged risks from stretched equity valuations, cyber threats and China’s property and financial strains; the Australian dollar hovered near US$0.66.

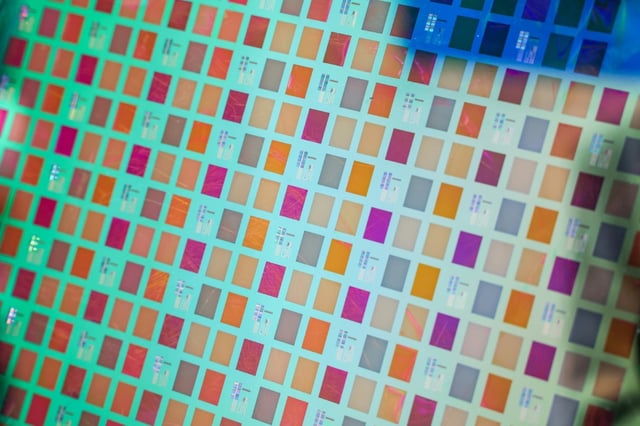

- Reports that China’s state iron‑ore buyer asked steelmakers to pause new BHP cargoes continued to unsettle the sector, even as iron ore held near US$104 a tonne and broader Asian equities rallied on tech strength tied to chip supply deals.