Overview

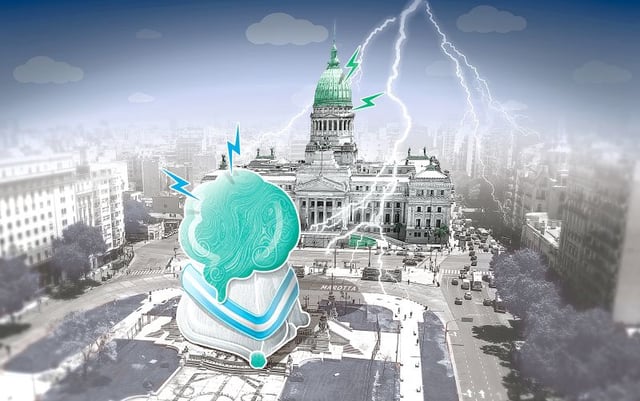

- Congress is weighing Article 10 of the Emergency Pensions and Retirement bill, which stakeholders say could eliminate the framework that supports the SGR system.

- SGRs act as guarantors that enable micro, small and medium enterprises to obtain loans from banks or tap capital markets by providing repayment backing.

- Beyond guarantees, these entities offer hands-on advisory services, from business planning to guiding firms into formal financial channels.

- Industry representatives point to the outsized role of micro and small firms in employment in Argentina, citing a direct link between SGR-backed credit and jobs and consumption.

- The Congressional Budget Office estimates the system’s annual fiscal cost at 0.017% of GDP, while sector leaders argue deeper capital markets would further strengthen SME financing.