Overview

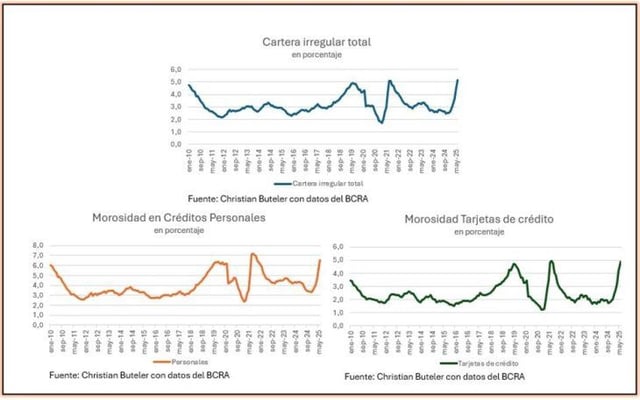

- Family-loan delinquency reached 5.2% in June, the highest since the BCRA began the series in 2010.

- Credit card past-due balances climbed to 4.9% in June, marking an eighth straight monthly increase and the second-highest level in 15 years.

- Personal-loan delinquency jumped to 6.5% from 5.6% in May, underscoring the stress concentrated in short-term consumer products.

- The overall irregularity ratio for private-sector credit rose to 2.9% in June, with the BCRA noting a broad-based deterioration across institution groups.

- Lending volumes still expanded, with credit in pesos up 4.2% in real terms in June, even as nominal borrowing costs hovered near 75% annually by mid‑August and banks began limiting financing offers.