Overview

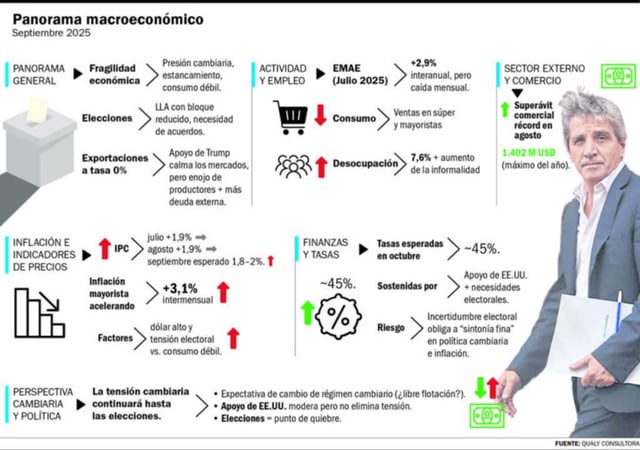

- Official EMAE data show output fell 1.5% from February to July, with analysts noting a small August bounce on private estimates and a weak September.

- A mid‑September currency run eased after statements of support from President Donald Trump and Treasury Secretary Scott Bessent and an advance of export receipts, yet country risk has returned above 1,300 points.

- Domestic demand has deteriorated as supermarket and shopping‑center sales decline, consumer credit remains largely frozen by high rates and rising delinquencies, and unemployment stands at 7.6% with growing informality.

- Monthly inflation has hovered near 2% for several months, including 1.9% in August, a slowdown consultants largely attribute to depressed consumption rather than policy traction.

- Consultancies say the near‑term path depends on the October elections, with a Milei victory viewed as likely to preserve U.S. financial support and allow more FX flexibility, while a defeat could heighten currency pressure and force emergency steps.