Overview

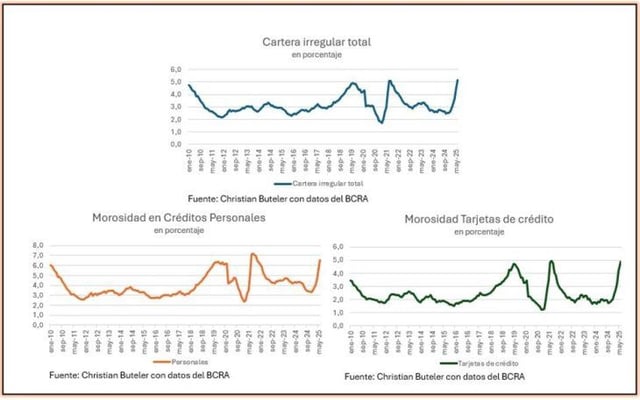

- Central bank data show household loan delinquency at 5.2% in June, the highest reading since the BCRA series began in 2010.

- Credit‑card arrears reached 4.9% in June after eight consecutive monthly increases, while personal‑loan defaults rose to 6.5% from 5.6% in May.

- Overall nonperforming loans to the private sector climbed to 2.9% in June, with deterioration concentrated in short‑term consumer credit.

- Lending remains buoyant, with credit in pesos up 4.2% in real terms in June and roughly 78.1% year over year, lifting household debt stocks.

- Banks have started limiting new financing as market rates rise and asset quality weakens, and analysts warn of risks to consumption and bank profitability if the trend persists.