Overview

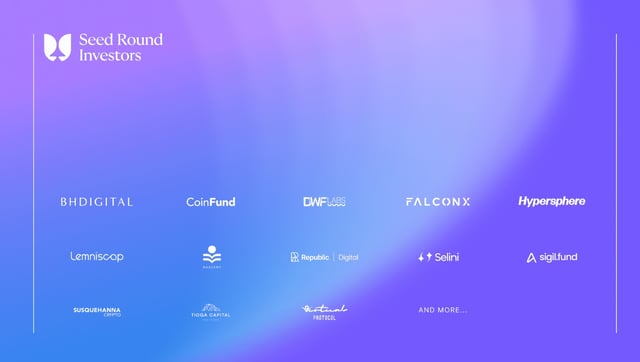

- Backers in the private round include Brevan Howard Digital, CoinFund, DWF, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, and Virtuals Protocol.

- The public sale will run on multiple blockchains at the same valuation, with supported assets, initial circulating supply, sale mechanics, and official contract addresses to be posted on flyingtulip.com before launch.

- All primary-sale participants can burn FT to redeem up to their original principal in the contributed asset from an onchain reserve, subject to programmatic limits and available funds.

- The team receives no initial token allocation, with exposure accruing only through scheduled open‑market buybacks funded by protocol revenues.

- Flying Tulip positions itself as a unified onchain marketplace spanning a native stablecoin, lending, spot, derivatives, options, and insurance, and it is targeting up to $1 billion across private and public phases with standard eligibility checks and phishing precautions.