Overview

- Advanced Micro Devices posted $7.69 billion in second-quarter sales, beating the $7.42 billion consensus while delivering adjusted EPS of $0.48 versus $0.49 forecast.

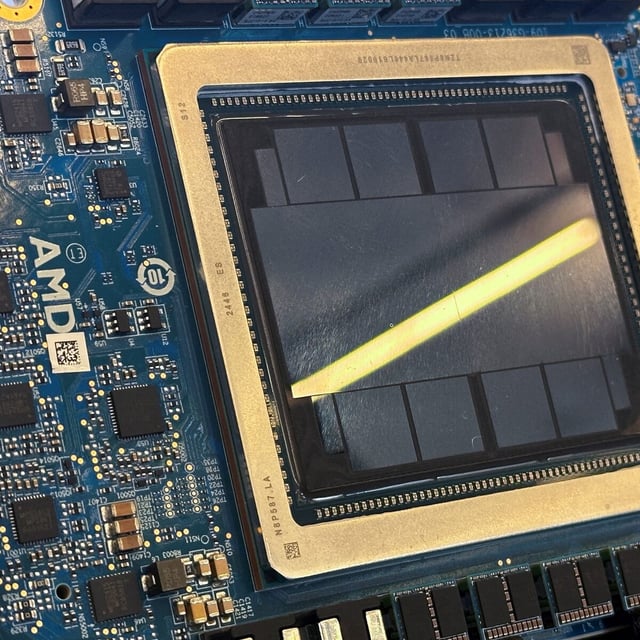

- US export restrictions on AMD’s Instinct MI308 AI GPUs generated roughly $800 million in inventory and related charges, with license applications now under Commerce Department review.

- AMD’s data-center revenue climbed 14% year-over-year to $3.2 billion and it guided third-quarter sales between $8.4 billion and $9.0 billion, driven by MI350 accelerators and CPU share gains.

- The company’s stock fell about 6% in early trading after its profit miss and export-related hit tempered enthusiasm for its top-line strength.

- Super Micro Computer’s fiscal Q4 results missed expectations with EPS of $0.41 and revenue of $5.76 billion, triggering a more than 20% stock plunge and a revised fiscal 2026 revenue target of at least $33 billion due to tariff impacts and delayed Nvidia Blackwell server ramps.