Overview

- SEBI last week closed Hindenburg-triggered probes, finding no evidence of related-party fund routing into Adani’s listed companies.

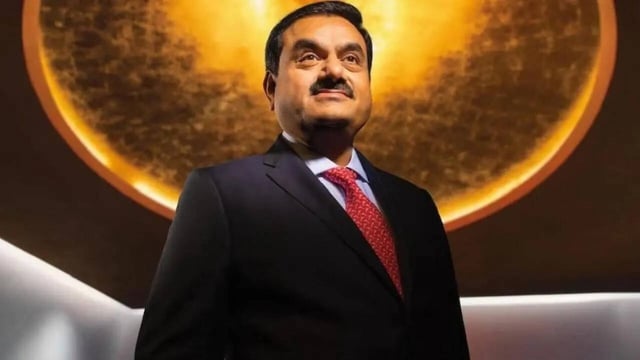

- In an internal message, Gautam Adani said the group will prioritize innovation, stronger disclosure practices, and long-term value creation.

- He cited sustained execution through the controversy, pointing to expansion across ports, power, renewables, airports, cement, and logistics.

- Adani Group shares extended gains, with Adani Enterprises up more than 80% year-to-date, as analysts said the closure removes a major domestic overhang and could lower financing costs.

- The domestic ruling does not address separate international cases, including a U.S. Department of Justice indictment alleging a $265 million bribery scheme.