Overview

- Bernard Arnault denounced Gabriel Zucman in the Sunday Times, prompting a swift rebuttal from the economist, who rejected the labels and urged a fact‑based debate.

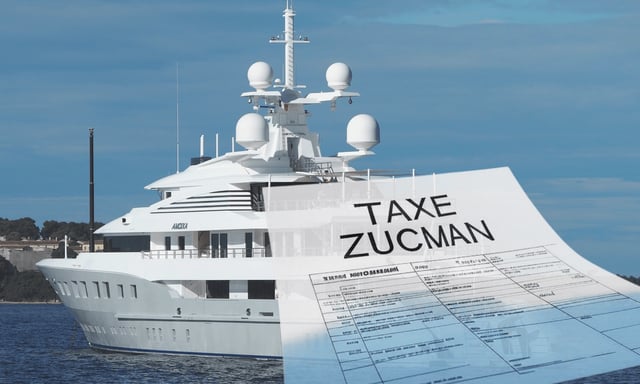

- The original plan targets net wealth above €100 million with a 2% annual minimum, affecting about 1,800 tax households; Zucman cites up to €20 billion in revenue, while other economists estimate closer to €5 billion.

- Business groups object that including professional assets would force sales, curb investment and innovation, and rely on volatile valuations of company shares.

- Government sources indicate work on alternatives such as a revised wealth contribution or a 0.5% tax that spares business assets, alongside tighter anti‑avoidance rules and a possible extension of last year’s exceptional corporate levy.

- The left presses for a robust measure as the PS warns against a token compromise, while centrists and the right criticize the Zucman design and RN figures dismiss it as unworkable.