Overview

- The project finance deal issues $750 million in notes maturing July 2029 with a $250 million top-up option, marking India’s first private airport bond rated investment grade.

- Apollo-managed funds led the transaction with participation from institutional investors and insurers including BlackRock-managed funds and Standard Chartered.

- The notes are expected to carry a BBB-/stable rating backed by Mumbai International Airport’s stable asset base, cash flows and operational performance.

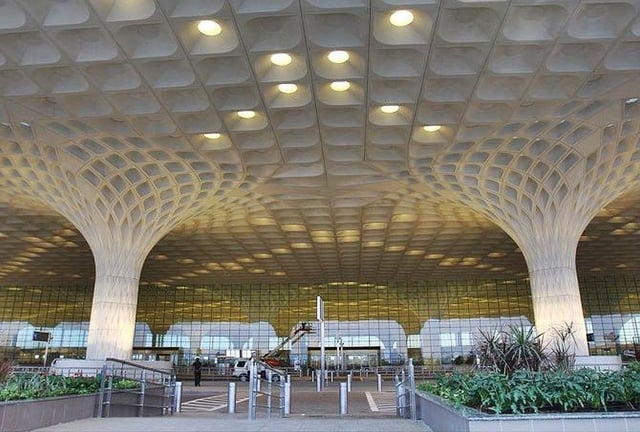

- Proceeds will enhance financial flexibility for MIAL’s modernization, capacity upgrades and sustainability roadmap toward net-zero emissions by 2029.

- The bond forms part of Adani Group’s plan to invest $15–20 billion annually over five years as Mumbai airport seeks to grow from 52 million passengers a year to a 229 million-passenger capacity.