Overview

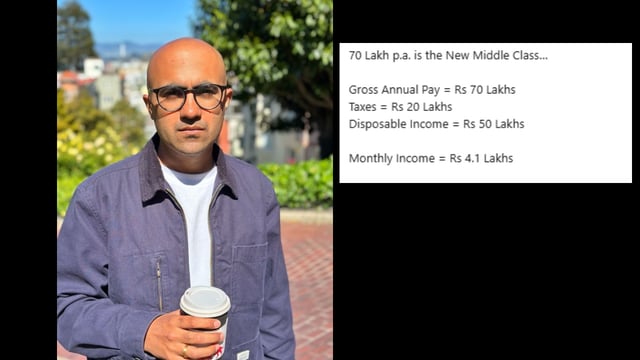

- Sarthak Ahuja’s LinkedIn post shows a ₹70 lakh annual salary yields about ₹4.1 lakh per month after roughly ₹20 lakh in taxes

- Fixed EMIs on a ₹3 crore home (₹1.7 lakh), a ₹20 lakh car (₹65,000), international school fees (₹50,000) and domestic help (₹15,000) absorb nearly ₹3 lakh of monthly income

- After covering these commitments, high earners are left with roughly ₹1 lakh to manage groceries, utilities, medical expenses and savings

- Ahuja highlights soaring inflation, disproportionate housing and vehicle costs along with aspirational social media-driven spending as primary pressures

- His advice to think twice before taking a housing loan has resonated with many but faces criticism from those who call the assessment misleading