Overview

- The superannuation guarantee has increased from 11.5% to 12% on July 1, marking the final rise in a decades-long rollout and boosting Australia’s A$4.1 trillion retirement pool.

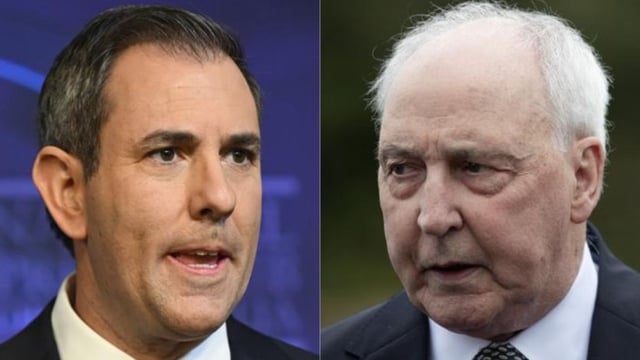

- Paul Keating hailed the 12% milestone and cautioned that a fixed $3 million threshold could ensnare future savers as compound returns drive balances higher.

- The government’s bill to backdate a 30% tax on earnings above $3 million hinges on Greens’ support in the Senate and faces debate over whether the threshold should be indexed.

- Employment Minister Amanda Rishworth dismissed Keating’s warning and reiterated that only 0.5% of super accounts will be affected under the current proposal.

- Economists from AMP and the Financial Services Council dispute that all new workers are guaranteed to accumulate $3 million by retirement under a steady 12% contribution rate.